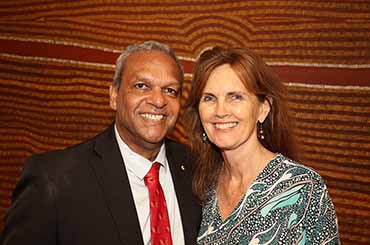

Partner - Tax

Board member

Aryk is a chartered accountant with over 26 years’ corporate income tax experience and has completed a Masters of Taxation.

Aryk provides tax advisory and compliance services to both listed and unlisted companies, foreign multinationals and high net wealth family groups. He also assists Not for Profit businesses to manage their tax risk and exposure.

Aryk's experience encompasses the provision of:

- complex taxation restructuring advice to both domestic and international corporate groups incorporating International Tax Agreements and tax consolidation along with inbound/outbound taxation issues

- client liaison services including leading multi-service (taxation) teams to deliver a holistic approach to both domestic and multi-national clients

- tax dispute resolution services including various liaison type roles with the Australian Taxation Office, the successful application for private rulings, and the provision of Reasonably Arguable Position Papers

- complex taxation advice regarding off market share buy-backs as an effective tax restructuring tool

- tax due diligence advice for both vendors and acquirers including consideration of complex post transactional structuring advice (mergers and acquisitions) and incorporating tax consolidation and the International Tax Agreements where appropriate

- advice to clients on taxation structuring for an Australian presence including thin capitalisation, permanent establishments and effective profit repatriation

- taxation advice regarding Australian entities holding foreign investments including offshore shareholdings and asset holdings

- Capital Gains Tax advice including the various CGT roll-overs available

Qualifications

- Bachelor of Commerce, Macquarie University

- Member of Chartered Accountants Australia and New Zealand

- Masters of Taxation, The University of Sydney